Summary of the Reports

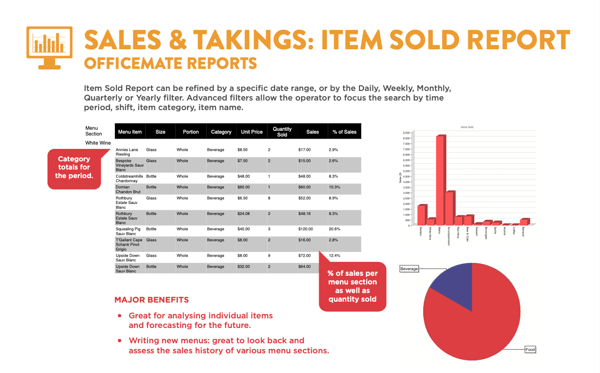

The Item Sold report is one of the most granular sales reports in the OrderMate software. Using the advanced filters will allow data to be customised and then analysed concisely. This reporting is not your usual end of day report, but more likely used to research the sales of a particular item or menu section when planning menus or even when re-ordering stock.

Note: To find these reports search 'Item Sold Report' in OfficeMate.

Available Filters in the Reports

- Custom Date Range, Daily, Week Ending, Monthly, Quarterly, Yearly

- All Day, Custom Time Range, Shift, Day Part

- Location

- Item Name

- Advanced: Section, Category, Size, Price Level, Account Type, User, Terminal, Customer Category

The Information in the Reports

- Select the advanced filter to filter by a range of additional parameters

- Multiple activities can be added to the advanced filter

- Once the information has been filtered in the main page, select the desired report from the tabs across the top of the screen

- View additional pages of the report using scroll arrows

- Disable the group item prices check box to see the actual price each item was sold at

Detail Report

The Bar Graph

- The total salve value for each menu section.

- Sales figures are including GST

- Sales figures are including discount or surcharges

Menu Section

- The name of the menu section

- The items for each menu section will be listed below (if sold)

Menu Item

- The name of the menu item sold (grouped by item name and portion)

- Items sold with different plus/options will be grouped

Size

- The name of the size of the menu item sold

- The same item sold in a different size would not be grouped

Portion

- The name of the portion of the menu item sold

- if the portion was not whole i.e. half-half, then each portion would be listed separately

- it would be possible to have sold fractions of 1.5 items if using portions

Category

- The name of the category the menu item is assigned to

Unit Price

- The average price the item was sold at

- Items are grouped by item name even if they were sold at different prices (giving the average unit price)

- Disable the group item prices check box to see the actual price each item was sold at

- Sales figures are Inc GST

- Sales figures are including discount or surcharges

Quantity

- The quantity of individual items sold

- It would be possible to have sold fractions of items if using portions ie. half-half would sell 2 x 0.5 items

Sales

- The total sale value of the item sold

- Sales figures are Inc GST

- Sales figures are including discount or surcharges

% of Sales

- The percentage of total sales for the menu item sold

COGs

- The $ Value 'Cost Of Goods Sold' for this menu item

- The item must be linked to stock item/s (ingredients)

- Stock Control module required

COGs %

- The % Value 'Cost Of Goods Sold' for this menu item

- The item must be linked to stock item/s (ingredients)

- Stock Control module required

Category Totals

- The last page of the report shows the category sales

Category

- The name of the category the items sold are assigned to

# Sales

- The quantity of all menu items sold, assigned to each category

Value

- The total sale value of all menu items sold, assigned to each category

- Sales figures are Inc GST

- Sales figures are including discount or surcharges

- Sales figures are reported at the time the items are ordered

% of Sales

- The percentage of total sales for category

Report Totals

- The report totals for all sales below;

Discounts

- The total discounts applied to the menu items sold

- Represented as a (+) positive value to indicate that the price was lower than the usual price (a + cost to the business)

Surcharges

- The total surcharges applied to the menu items sold

- Represented as a (-) negative value to indicate that the price was higher than the usual price (a - cost to the business)

Sales Total (Inc Tax)

- The total sale value of the items sold

- Sales figures are Inc GST

- Sales figures are including discount or surcharges

- Sales figures are reported at the time the items are ordered

TAX

- The total value of the tax applied to the items sold

Summary Report

Menu Totals

- The report totals for all menu section sales below;

Menu Section

- The name of the menu section the items sold are in

# Sales

- The quantity of individual items sold in this menu section

Sales

- The total sale value of the items sold in this section

- Sales figures are Inc GST

- Sales figures are including discount or surcharges

- Sales figures are reported at the time the items are ordered

% Sales

- The percentage of total sales for the menu items sold in this section

COGs

- The $ Value 'Cost Of Goods Sold' for this section

- The items must be linked to stock item/s (ingredients)

- Stock Control module required

COGs %

- The % Value 'Cost Of Goods Sold' for this section

- The items must be linked to stock item/s (ingredients)

- Stock Control module required

Category Totals

- The report totals for all category sales below;

Category

- The name of the category the items sold are assigned to

# Sales

- The quantity of all menu items sold, assigned to each category

Value

- The total sale value of all menu items sold, assigned to each category

- Sales figures are Inc GST

- Sales figures are including discount or surcharges

- Sales figures are reported at the time the items are ordered

% Sales

- The percentage of total sales for the category

Pie Chart

- Each category is visually represented in the pie chart

- Each category is labelled

Report Totals

- The report totals for all sales below;

Discounts

- The total discounts applied to the menu items sold

- Represented as a (+) positive value to indicate that the price was lower than the usual price (a + cost to the business)

Surcharges

- The total surcharges applied to the menu items sold

- Represented as a (-) negative value to indicate that the price was higher than the usual price (a - cost to the business)

Sales Total (Inc Tax)

- The total sale value of the items sold

- Sales figures are Inc GST

- Sales figures are including discount or surcharges

- Sales figures are reported at the time the items are ordered

Tax

- The total value of the tax applied to the items sold